Joanna Seddon, Managing Partner, Presciant

Nikhil Gharekhan, Managing Partner, Presciant

Never has there been a year in which the brand landscape has been so transformed. Never have there been such clear winners and losers, and in some cases very unexpected ones. Our brand valuation estimates for 2020 show dramatic shifts among the most valuable brands.

Lessons from 2020

Changes in the value of brands have been driven by two main factors.

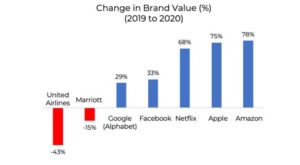

The first is category. Some categories are way up, and some are way down. The value of brands in travel and hospitality has collapsed, along with the number of travelers and sales. The United Airlines brand is estimated to have lost $1.4B of value (43% drop), the Marriott brand $1.5B (15% drop), as sales tumbled by 78% and 56% respectively. Simultaneously, the value of brands in tech has shot up, as they have become our main window to the outside world, whether it is by connecting us with others, keeping up with the news, bringing the groceries in, or providing us with entertainment. Presciant estimates that the value of the FAANG brands (Facebook, Apple, Amazon, Netflix, Google) has shot up from $1.2 trillion to $2.0 trillion since the onset of the pandemic.

The second is how each brand has handled the crisis. No matter what the category, some brands have done outstandingly better than others. Delta took clear and consistent action early on to leave middle seats open and create social distancing on its planes, leading its stock to do 10 ppt better than United, and its brand value to overtake its rival. The Ford brand and business have outperformed GM as Ford transitions faster to electric vehicles, but the brand value of Tesla is 16 times the two combined. While Marriott’s brand value has sunk to $8B, Airbnb’s has soared to $35B, with its stock up almost 150% since its IPO in early December. The Airbnb brand is reaping the results from emphasizing the social distance benefits of individual units and the introduction of its Enhanced Cleaning protocols.

What determines winners and losers

The winning brands are an odd bunch. They cluster at two extremes. At one end are the very traditional trustworthy brands, whose functions and attributes are particularly appropriate to the crisis—Clorox (hygiene), Oreos (fun), Kraft Mac & Cheese (comfort), Lowe’s (home improvement) At the other end are future-oriented disruptive brands riding trends accelerated by the pandemic—Zoom (collaboration), Impossible Burger (health & sustainability), Peloton (fitness), Calm (wellbeing).

Losing brands misplayed the crisis. Some overreacted, and were criticized as inauthentic, sometimes attracting outright hostility—KFC (finger-licking good), Lysol (too upbeat while out of stock), Norwegian Cruise Lines (showing people enjoying cruises), Hershey (hugs and handshakes), Axe (ads in basketball crowds). Others under-reacted and hid their heads in the sand, pulling their advertising. Coca-Cola was a major example of this. The company decided that contributing to the conversation wouldn’t drive enough short-term profits and paused all of its marketing spend in April. State Farm, wishing to distance its advertising from any bad news, also pulled back from its major advertising and sponsorship commitments.

And now, in the last few months, we are seeing a brand bubble. It mirrors an IPO bubble which has reached dotcom levels. The most hyped include DoorDash, called “the most ridiculous IPO of 2020,” whose market cap rose to from $39 to $72B on the first day of trading, Airbnb (IPO’d at $47B), Snowflake (IPO’d at $33B in September, now at $100B), Tesla (stock up 4125% since its IPO 10 years ago). More and more are coming, including Robinhood and Instacart.

And now, in the last few months, we are seeing a brand bubble. It mirrors an IPO bubble which has reached dotcom levels. The most hyped include DoorDash, called “the most ridiculous IPO of 2020,” whose market cap rose to from $39 to $72B on the first day of trading, Airbnb (IPO’d at $47B), Snowflake (IPO’d at $33B in September, now at $100B), Tesla (stock up 4125% since its IPO 10 years ago). More and more are coming, including Robinhood and Instacart.

This stock market bubble is causing a brand bubble which is continuing to inflate. As investors pour money into new financial vehicles such as SPACs, and the money raised by IPOs grows, so does the brand value of these companies. Most of these companies have little to no tangible value—they don’t make any money. DoorDash lost $666M in 2019 and $149M in the first 9 months of 2020; Airbnb lost almost $700M in the first 9 months of 2020 and is now struggling back into profit. The value of these companies is purely intangible. The intangible assets include technology, brand and, in these cases, a third factor, hype based on future expectations. Technically, this leads to overstating of brand value, as it is virtually impossible to split out the intangible value between brand and hype.

How much of this brand value is real, and how much is hype which will vanish when the bubble bursts? This is a major question for 2021.

Predictions for 2021

All the signs are that we have truly moved from “Kronos” time, a 9-to-5 predictable regulated world, to “Kairos” time, an era when things ebb and flow and constantly change. In 2021, we will continue to live in uncertainty, what the US military calls vuca—volatility, uncertainty, complexity and ambiguity.

The brand bubble will burst

The value of some brands will fall dramatically while others will continue to rise. Some brands which are on a tear today will disappear altogether. Events will reveal what brand value is real and what is hype.

There will be a repeat of some of the failures of the dotcom bubble when Pets.com, an online pet supplies seller, raised $82.5B in its Feb 2000 IPO, and by November of the same year, was out of business, and Webvan, a grocery delivery business, IPO’d for $4.8B in November 1999, lost over $800M, and shut down in June 2001. And there will be other successes, just as in the early 2000s, other dotcoms survived, including Amazon, Ebay, and Cisco, and have grown to be among the world’s most valuable brands.

Which brands, hot now, will fail and which will win?

Failures—Presciant’s prediction: hyper-hot brands which will die or shrink dramatically are those focused on short-term exploitation of the current crisis. Likely candidates are Animal Crossing (targeting stressed out people looking to fill lockdown hours), Solo (firepits for social distanced gatherings in backyards), King Arthur flour (catering to the passion for home baking, which is already proving to be short-lived), and Crocs (benefiting from a fetish for ugly comfort at home).

Winners—Presciant’s prediction: hot brands which will endure are those riding longer term trends accelerated by the crisis. We are betting on the continued success and growth of Zoom in video conferencing, Instacart in delivery, Netflix in home entertainment, Tesla in automotive, and of course Amazon’s increasing domination of ecommerce. All of these brands have the ingredients to sustain success despite the efforts of lagging traditional competitors to catch up, from Microsoft Teams and Skype, to Walmart, Disney, Ford and GM.

Which established brands will thrive in 2021 and beyond?

Presciant’s view—some brands will prosper because they innovate to profit from the new environment. These brands spot the fact that the crisis opens up new avenues for new things, new offerings, new innovations. They are taking the opportunity to reinvent themselves and change where they put their R&D dollars. Others, that assume a return to the status quo pre-crisis, will meet unpleasant surprises, become less and less relevant, and fade away. There is an imperative for change. Some things will never be the same. The office of old has gone—we are entering the age of the hybrid worker. The real estate market will see the revival of smaller towns and cities. How homes are built and designed will be rethought to meet the new space and technology needs of remote working. There will be no more purely in-person events—conferences and entertainment will be simultaneously in-person and online (Warner Bros. is launching its entire slate of 2021 movies both on HBO Max and in theaters). Retail will shift online or die, though stores will continue to exist for browsing, experimentation and pick-up. Sad abandoned malls will increasingly be repurposed into medical offices, warehouses, schools, housing, museums and indoor farms.

Presciant’s view—the brands of the future will be those who have changed their attitudes, their treatment of people, and their products to meet higher standards of social behavior. The history of previous crises shows that the demand for this may regress from where it is now but won’t go back to where it was before. Norms have moved to a higher plane, in terms of social justice, health and sustainability. Successful brands will be more diverse in their hiring, product ranges and communications. Make-up will come in a multiplicity of shades that anyone can wear, following the model set by Rihanna. Food and beverage offerings are transforming. Dairy and meat brands are in decline as plant-based products take over supermarket shelves, fast food menus, and restaurants. Every brand in every industry has to consider the health and wellness implications of what they sell and do. Fashion brands are transforming their products and businesses to meet consumers’ new insistence on sustainability. Stella McCartney has led the way, now everyone is following. Disposability is no longer chic. Fur and leather are no longer cool. Recycling and thrift stores are in. Better treatment of workers is demanded.

Above all, successful brands will be those which are comfortable with uncertainty, which recognize the need to take nothing for granted, shift on a dime, and act fast.

What brands must do

Lead with purpose

Have a strong purpose and bring the corporate brand out into the marketplace. Now that brands are judged by their behavior, the corporate brand and its reputation is more important than ever before.

Make sure that the purpose is reflected in every aspect of the business, from who you hire and how much you pay them, to what you make, what you do, and what you say.

Be radically transparent. Open to every new idea. Tolerate and encourage experimentation and failure. Admit your mistakes and missteps, don’t hide them.

Recognize the importance of brand. Make sure brand is treated with the respect it deserves as the source of business growth. Elevate the CMO’s job to growth leader. Make sure the CMO has the qualifications and experience to fit this role. Strive for brand and marketing to have a seat at the table with executive committees and boardrooms.

Get the CEO to make the brand their own. Ensure that they believe in it, live up to it, and are visibly involved where it matters.

Look ahead

Never stop anticipating. Start from the future and work back. Don’t just focus on reacting to today’s demands and next quarter sales.

Rethink your portfolio and innovation strategy by projecting where the world and your customers will be in 10 years’ time. Balance your innovation and marketing dollars between the businesses you have today and the ones you need for the future. Identify the products you have that don’t fit the future and develop a strategy to reimagine or transition them. Identify the products you don’t have but need to meet the desires of future customers; the categories you are not in where the growth will be; and the future markets you need to expand to. Develop a strategy to add them, whether through innovation or acquisition.

Review the business models through which you take your brands to market. Explore opportunities to get much closer to your customers by accessing them directly. Knock down all boundaries between “e” and other commerce.

Reorganize your portfolio to reflect your different relationships with your customers. Use customer relationship as the organizing principle to determine your architecture and how you apply your corporate and product brands to different situations.

Target more stakeholders

Look beyond customers and investors. Add society and community to the key audiences for your brand. Understand how all stakeholders create value for your business and how you can add value to their lives. Tailor your messages accordingly.

Think of your audiences as people not as roles. Accept that there is no longer a distinction between B2B and B2C. Consider that the same person may interact with your brand in their work and personal lives. Design your brand experience to be 360 and touch audiences in different aspects of their lives.

Devolve more decisions

While retaining central control of brand purpose and essence, reverse the traditional top-down line of command where possible. Replace control with education so that it happens naturally. Allow local managers to make on-the-spot brand decisions. Let them take responsibility for anticipating and solving customer problems. Trust them to experiment with brand innovations as long as they tell you first.

Measure, measure, measure

Broaden and modernize how you measure your brand. You do need to know how customers perceive your brand, but you don’t need heavy, clunky traditional brand equity research. Take a mobile first approach. Add big data and digital analytics, but don’t let that drag you down into being purely sales and short-term focused. Expand measurement to new audiences and consider societal impact. And link everything to financial results. Put brand on the same level as other assets of the corporation and demonstrate its ROI. Then you have a chance of getting the right level of funding for marketing. And brand and marketing will take their rightful place in the boardroom.

For more information, please visit: www.presciant.com