By Sandeep Vasudevan, Partner, Presciant

Let’s be blunt. If your marketing budget is like most, it isn’t strategic. It’s inherited.

Last year’s number, nudged up or down depending on mood, margins, or whether the CFO had caffeine that morning.

We dress this up with “benchmarks,” “share of voice,” and “industry norms,” but everyone in the boardroom knows the truth:

Marketing budgets and marketing objectives are created independently and then forced to coexist. It’s no wonder neither survives contact with reality.

The CFO Isn’t the Enemy — They’re Just Not Buying Hope as a Strategy

CFOs aren’t anti-marketing. They’re anti-unproven investment.

They approve capital for R&D, manufacturing, infrastructure because those requests are backed by models, assumptions, sensitivities, and financial logic.

Marketing turns up with slogans, trackers no one uses, and a number reverse-engineered from media plans.

You lose marketing budget not because marketing is hated, but because you’re the only function that can’t quantify its marginal value.

The Real Problem: Marketing Can’t Prove What It Wants Funded

Most marketers sit on gold: Brand trackers full of salience gaps, equity drivers, and competitive blind spots.

Yet very few use this data to set investment levels. So budgets get approved without evidence, and objectives get set without feasibility.

That gap between ambition and investment is where growth quietly dies.

There Is a Scientific Way to Set a Marketing Budget. You’re Just Not Using It.

Brands are measurable commercial assets. Their financial impact can be modelled with the same discipline applied to any capital request.

Presciant applies the same forensic method used in valuation and capital allocation:

The Evidence-Based Budget Blueprint™

Presciant’s proprietary Evidence-Based Budget Blueprint™ changes the conversation. This approach isn’t marketing theory—it’s a forensic, C-suite-tested method for setting the right budget, for the right reasons:

- Quantifies brand contribution: Regression analysis measures how additional investment raises specific brand equity KPIs. No more “squishy” metrics.

- Links brand equity to real financials: Brand uplift data feeds into robust financial models that directly tie changes in brand strength to revenue, profit, and overall company valuation.

- Scenario-tested: Models account for baseline, moderate, or aggressive investment options, all benchmarked against your sector and key competitors. Every recommended number is defensible.

Three critical advantages marketers rarely have access to:

- Focus on sustained impact: Most methods try to correlate marketing activity to immediate sales. But marketing also influences customers longer-term, ensuring future earnings. Our approach quantifies the short-term and long-term impact of marketing.

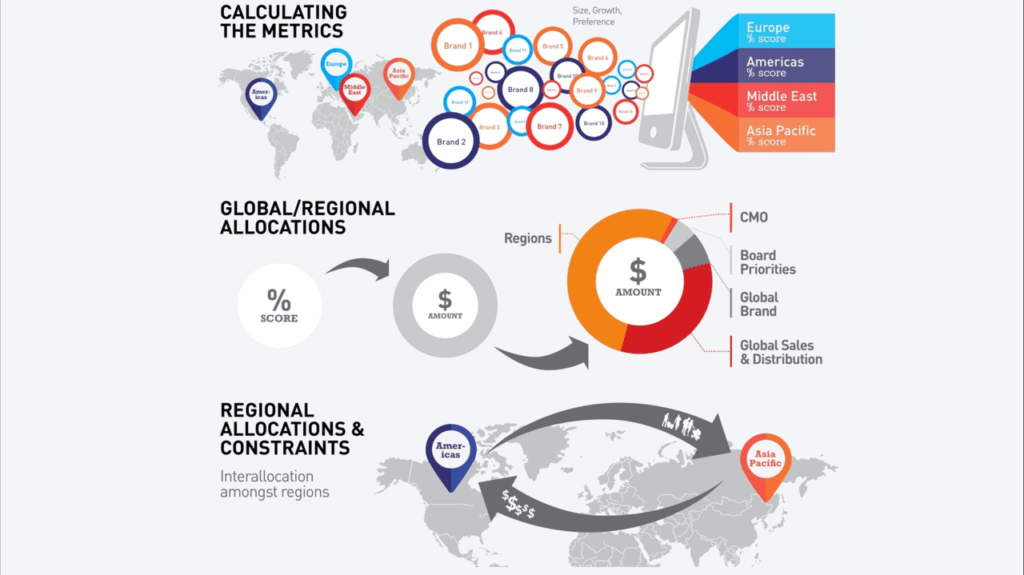

- Portfolio-wide optimization: We can allocate budgets across a complex portfolio of brands, ensuring each brand receives the investment required for its specific commercial role, market context, and growth trajectory. No more blunt “peanut butter spread” budgeting.

- Geographically precise budgeting: We can determine the right spend levels by region, market, or country reflecting competitive intensity, brand equity variance, and differing category economics across the world.

And most importantly:

- CFO-ready justification and KPIs: The Blueprint produces investment numbers backed by the financial logic CFOs trust; ROI, NPV, payback period, and clear KPIs tied directly to revenue and margin outcomes. This means marketers walk in not with a “request,” but with a capital investment case that the CFO can approve and measure.

Proof: When You Model It Properly, the Money Appears

Real cases show what happens when investment is set empirically:

- A global pharma company uncovered $2.7B in incremental revenue by closing the corporate brand equity gap.

- A health insurer justified a $200M media investment that generated $2.8B in shareholder value.

Not theory. Not hope. Evidence.

The Punchline

The “right marketing budget” isn’t a guess. It’s a calculation.

If marketing wants to stop being the first department cut, it must start operating like every other capital-intensive function:

- Quantify the revenue brand drives today

- Quantify the revenue available by closing equity gaps

- Calculate the investment required

- Demonstrate the return versus other uses of capital

Do that, and the budget conversation changes instantly.

Presciant’s Role—Simple

We replace guesswork with:

- Evidence

- Financial modelling

- Scenario plans

- Competitive benchmarks

- A defensible investment case

The result: A marketing budget tied to reality, not ritual.

If you want a budget that actually matches your objectives and proof a CFO will take seriously, we can build it.