by Yitzchak Grant

Nike Brand: From “Just Do It” to “Just Missed It”

When I was a teenager Nike was THE brand. Sneakers, tracksuits, whatever it was—“Just do it” wasn’t just a slogan, it was a mindset. Nike pioneered a category led strategy sport by sport not shoe by shoe, from track to basketball to tennis and finally street style and collectors.

Through the 2000s and 2010s, the Nike brand seemed unstoppable: owning innovation, innovating sneaker customization, and pioneering connected fashion. Nike’s in-store retailtainment acted as inspiration for marketers across other industries.

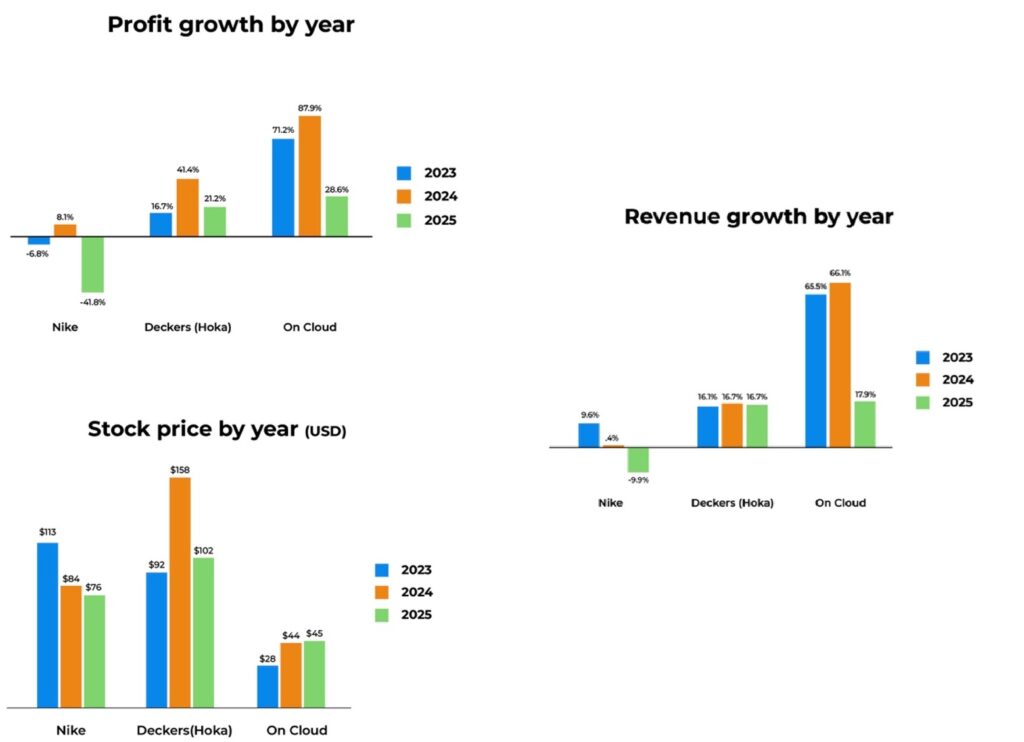

Fast forward to today. Nike’s results—and share price—are anything but inspirational. On the subway and in the street people are wearing HOKA and On Clouds.

What Caused the Nike Brand Fall

So, what happened?

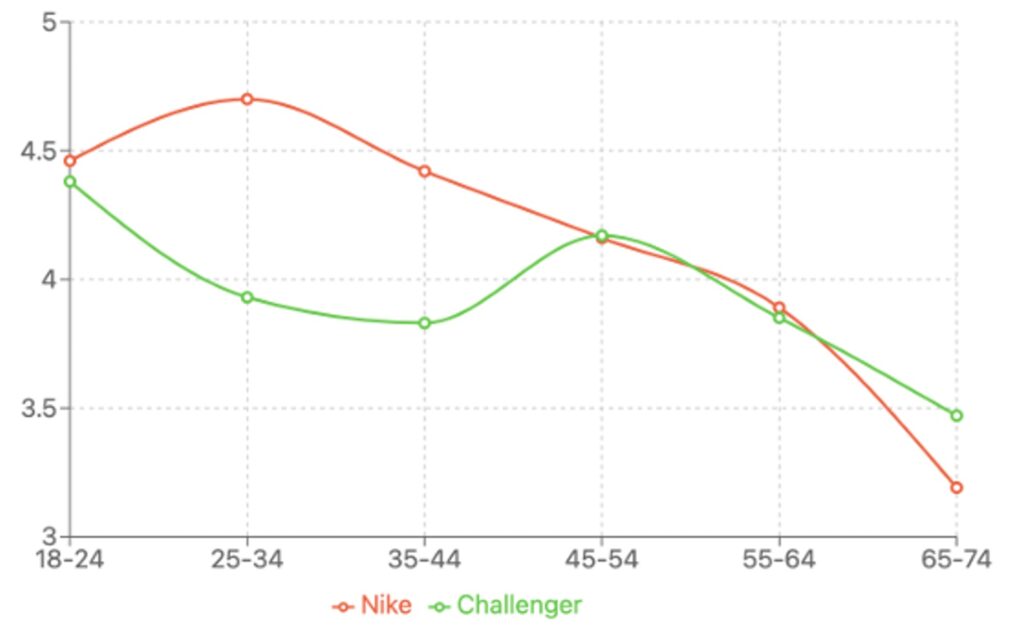

This chart from Edgar Baum at the 2025 Marketing Accountability Standards Board (MASB) Spring Summit stuck with me:

Nike still owns the hearts of Gen Z and millennials. Their purpose-led, inclusive, sustainability-first image hits home with under-45s.

However, it is a very different story with the older cohort. Nike’s brand strength drops off sharply vs challenger brands.

To be clear, this isn’t about older generations rejecting inclusivity. It’s about relevance. Over-45s aren’t looking for shoes to reflect their beliefs—they’re looking for footwear that fits their lives. Technical performance, medical support and comfort. Think bunions and flat feet, not carbon offsets.

Follow the Money

So why should Nike care?

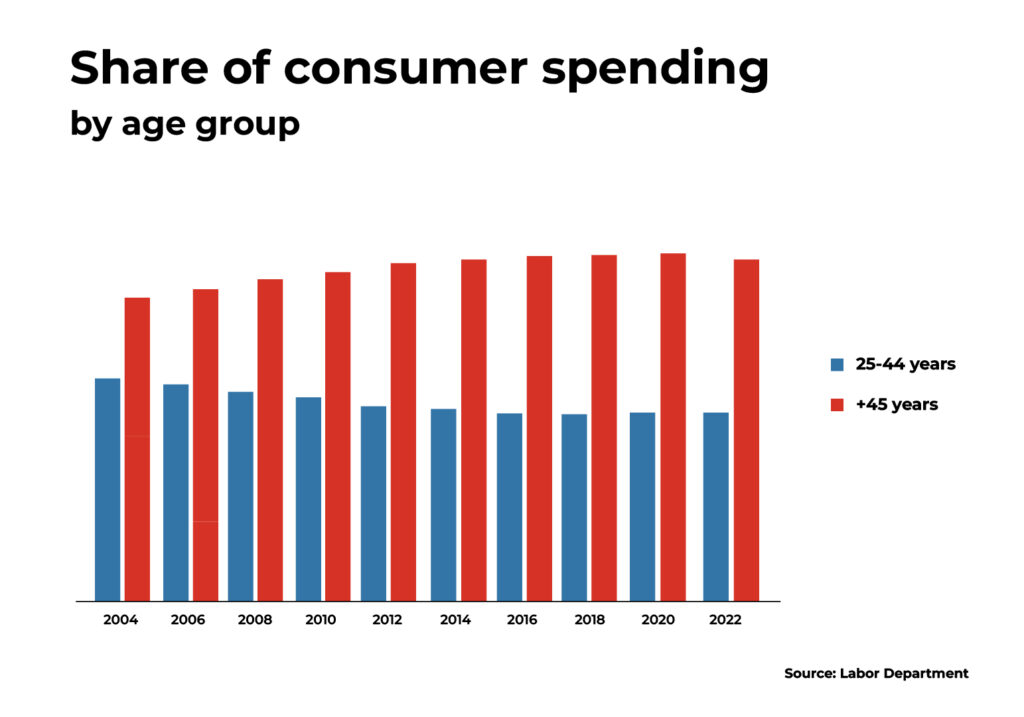

Because, as Deep Throat said: follow the money.

Younger people love Nikes. They just can’t afford them. The “silver economy” holds the purse strings. Over-45s have more disposable income, buy more frequently, and prioritize function over fashion.

The combination of this marketing strategy together with their distribution strategy, when they withdrew from retailers and Amazon to offer their products exclusively on nike.com was a recipe for disaster. This was compounded by then offering pricing discounts, further eroding brand equity and losing their exclusive image.

Ultimately by focusing only on the younger cohort, they excluded a key profit pool. This means Nike is seeing a reduction in profit and therefore has a correspondingly lower share price.

Age correlates with income, household composition influences purchase volume and decisions. Empty nesters at the peak of their careers are a huge source of opportunity.

So why ignore them?

In a word – cool. They aren’t cool people, they aren’t trend setters. It’s much trendier as a young millennial marketeer to relate to people your own age, talk about mindsets and behaviors. But your CFO doesn’t care how cool the target audience is – they want you to show them the money!

This does not mean abandon your consumer segmentation, but triangulate between data points and always, always measure the money.

It’s Not Just the Nike Brand

This isn’t just a Nike brand problem.

Jaguar launched their infamous “copy nothing” campaign last year. It was a bold gamble of which by the way, we should see more. However who were they targeting? How many Gen Z’s can afford a Jaguar? And was the creative truly original? It was reminiscent of a Smirnoff advert – ‘We’re open!” – rather than a luxury car brand.

The result – the CEO left for early retirement this month.

We have spoken about the Bud Light fiasco. It has been interesting to see their campaigns in 2025 – they got the message, maybe too late. Their Superbowl ad featured 37-year-old Shane Gillis as a suburban dad. Their more recent campaigns such as the Armchair Quarterback feature 49-year-old Peyton Manning and friends, sitting on the couch watching the game. Both campaigns clearly target the older drinker who maybe grew up with Bud Light but crucially is still buying and drinking beer.

This isn’t an original strategy. When Michelob Ultra launched in 2002 it went straight for the boomers. Their current ads feature actors such as Catherine O’Hara and Willem Dafoe enjoying Pickleball for example. The results – Michelob has risen to become the #2 beer in America.

For decades Toyota has taken the opposite approach to Jaguar and has highlighted middle aged characters hiking, biking and enjoying the outdoors. The messaging was clear – “you’re not winding down; you’re shifting into exploration mode.” The results are in: #2 position overall in America, and #1 with middle aged drivers for over a decade.

Diageo Needs to Learn Lessons Like Nike

Diageo just released its results and it’s not pretty. Profits are down; sales are flat. The reason? Young people are not drinking anymore. Their solution to date – non alcoholic drinks. The result – the share price is half of what it was five years ago.

This has not been thought through.

First, if young people aren’t drinking, then they aren’t in the bar to begin with, they aren’t in the alcohol aisle or in the liquor store. So, who are you selling to?

Secondly, they have no money! A pint of beer in NYC is around $10, a cocktail closer to $20.

Thirdly, you know who does have money? You know who is spending $8 of every $10 in store? It’s people over 34. 70% of US wealth is held by people over 50 years old. Focus your efforts, follow the money and the shareholder will reward you.

Afraid Your Brand Will Age Out?

“But hang on,” I hear you cry, “if I don’t recruit young people my brand will die?”

If your core consumers are 45 and they stay loyal until 65, that’s 20 years of cash flow why toss that away trying to chase a 22-year-old who isn’t interested? Middle aged consumers are more brand loyal, less price sensitive and more connected to heritage. We’re not saying abandon the youth cohort but maintain your cash flow with the middle aged while making incremental long term moves with the youth. The Texas Rangers have done it – so can you.

Taking lessons from the Nike brand and Diageo, here’s your bottom line:

- Chase commercial relevance before cultural relevance

- Chase the buyers driving category growth

- Chase profits, watch the numbers

Brands don’t die because they fail to attract 22-year-olds. They die when they forget the 42-year-olds who kept them alive

At Presciant we connect brands with cash flow – want to know how – why not give us a call?